Hedge Strategy

Our robot can monitor the market throughout the trading hours. Besides that, it can place order at the right time as what you expected. See how our robot saves your hedge cost below.

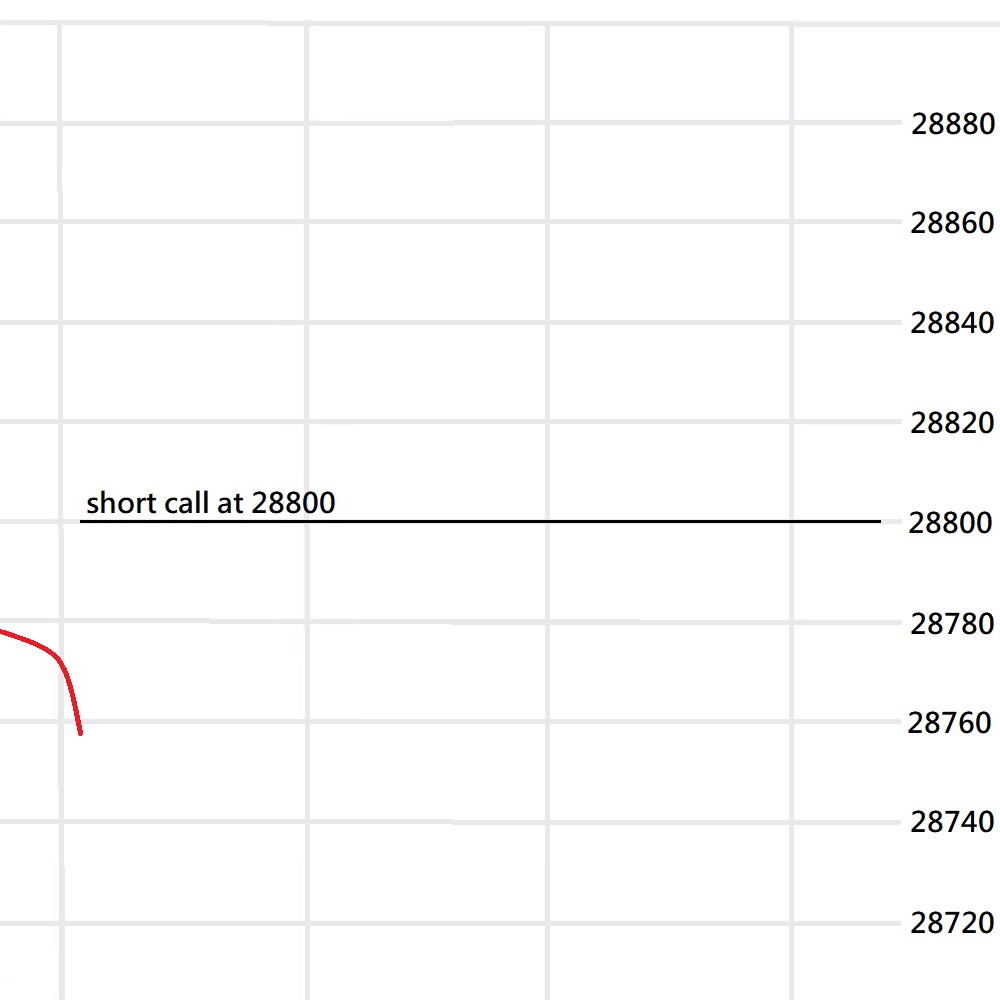

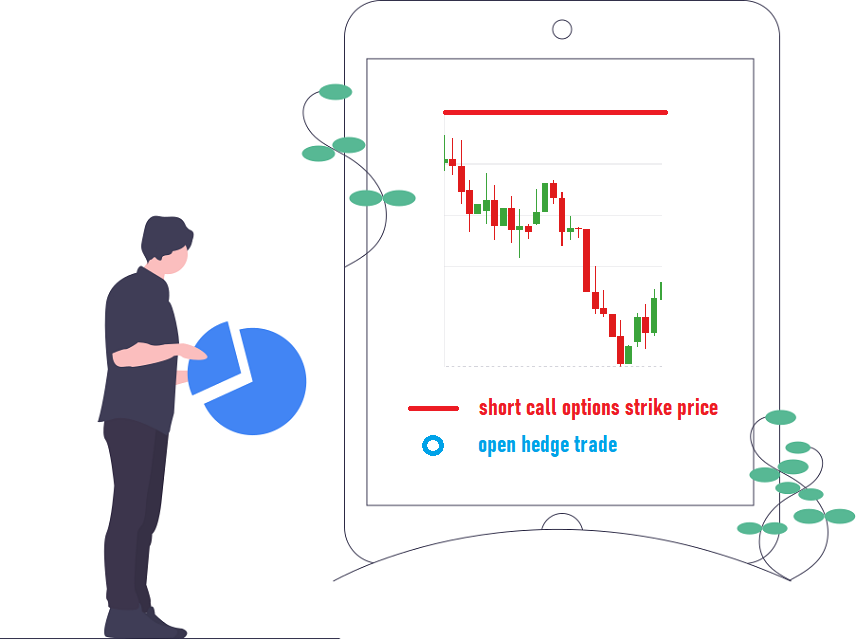

Short a call options

You think that the economic environment is bad now. The market price should not rise over 28800 points in this month. You placed a HSI short call options order at strike price 28800.

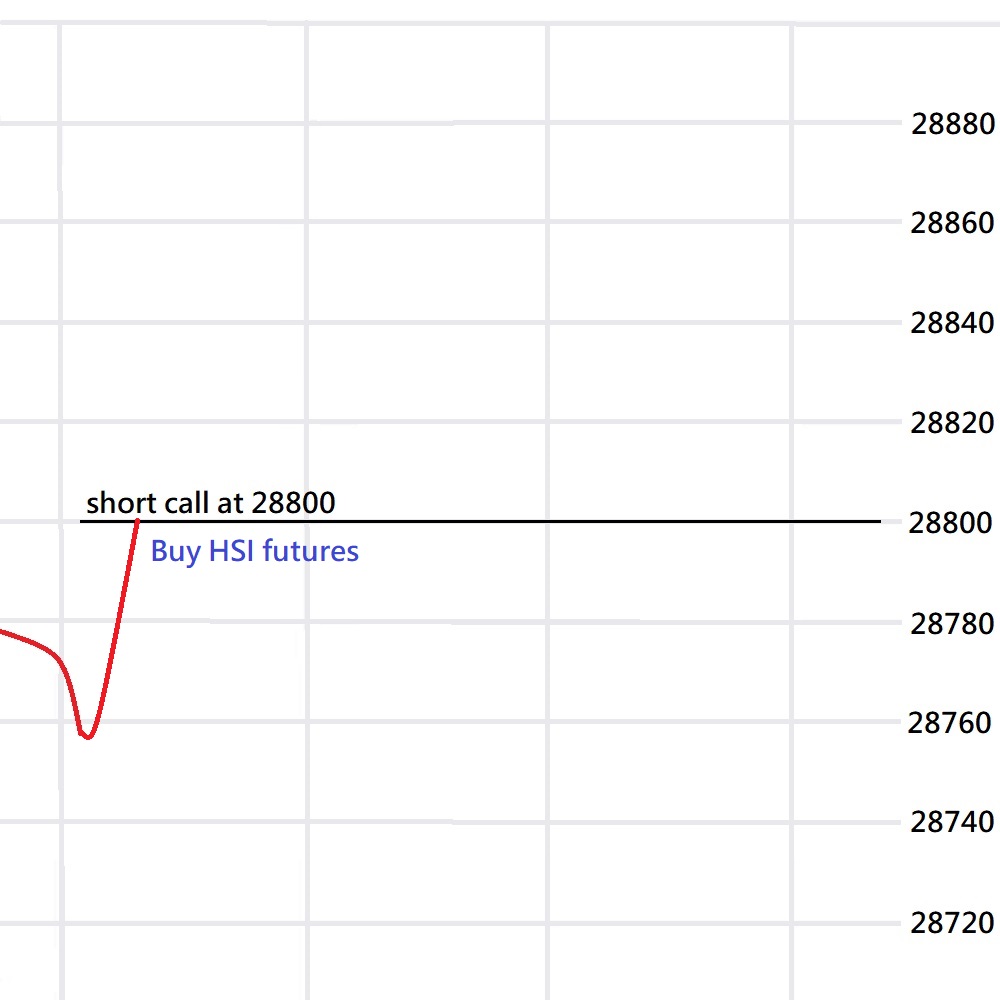

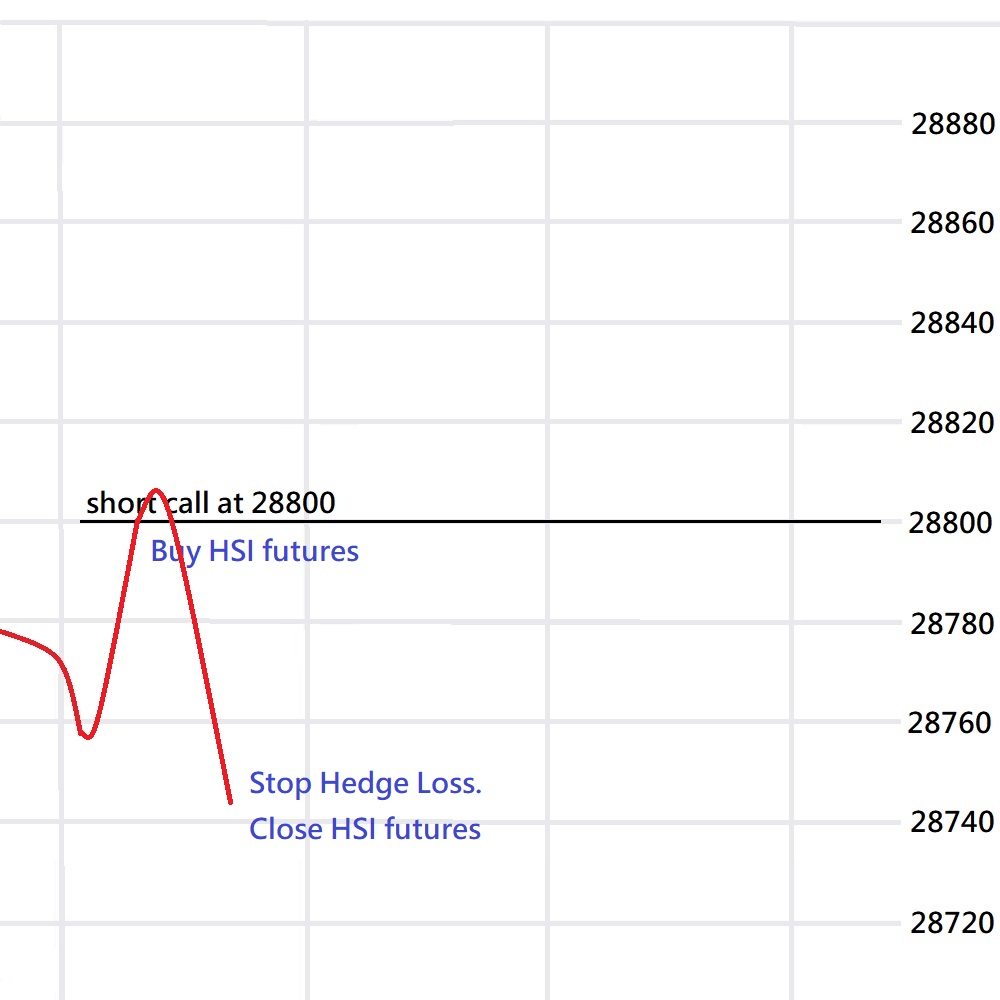

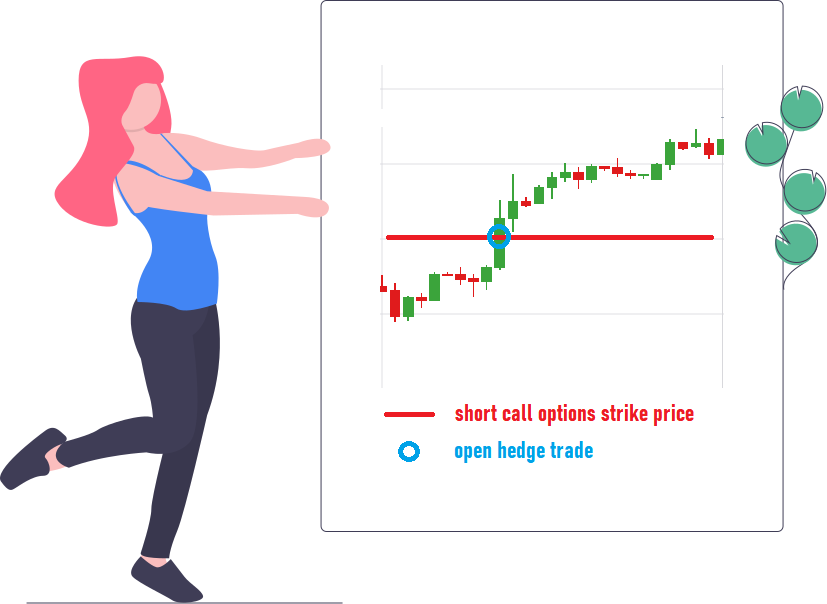

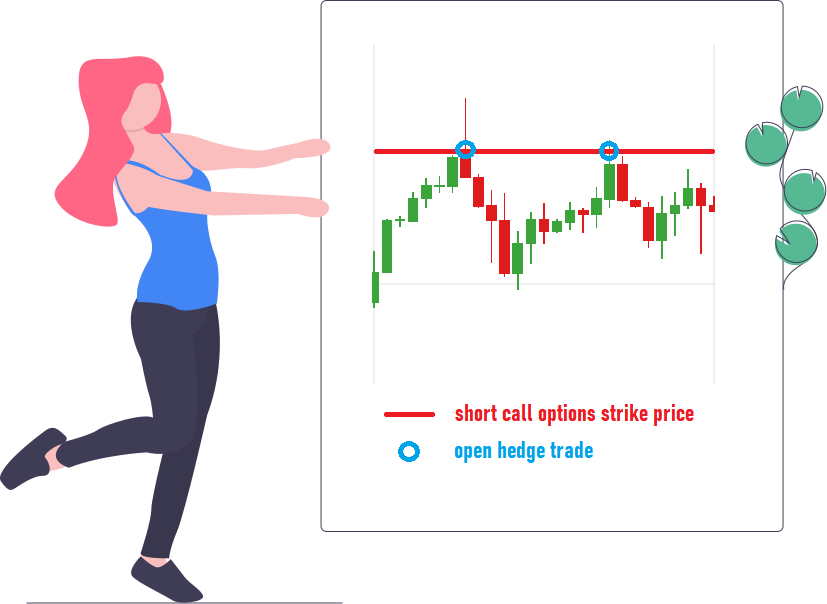

Market hits your strike price

Unfortunately, the participants in the market does not think so. Market price rises and hits your strike price 28800. You are not sure the market price will continue to rise or not. You are at risk now. Our robot knows it and places a HSI futures buy order. Even the market price continues to rise, you won't lose in the market uptrend. Furthermore, you can still earn the premium from the options.

Stop loss

If the market price drops back to your strike price, you don't need the hedge trade anymore. You have full control on when to close the hedge trade. For example, if you set the stop loss to 50 points, our robot will close the hedge trade at 28750.

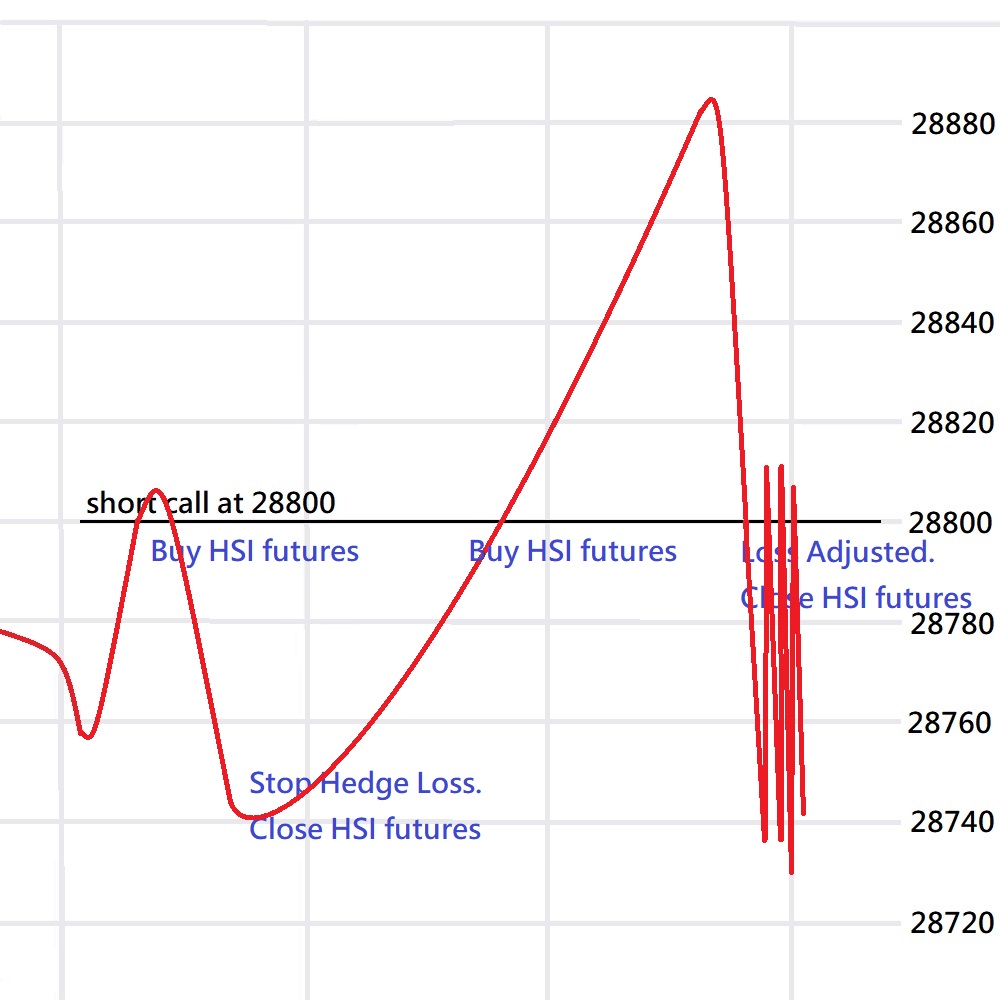

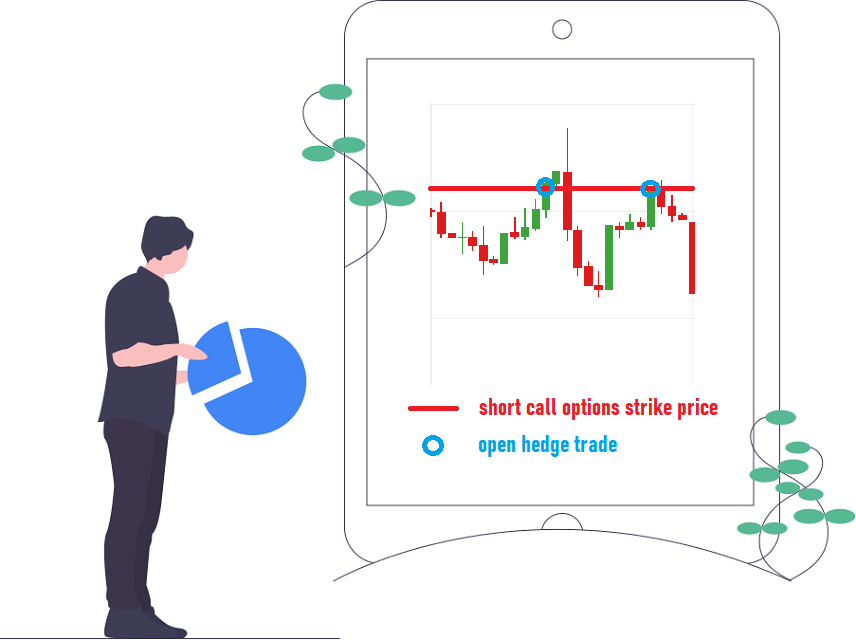

Loss adjustment

Obviously, each hedge action will cost you [stop loss] points. We don't like that. If the market price goes over your strike price for certain points already, our robot changes the [stop loss] to 0 point for the existing trade so that you have no hedge cost on it. That "certain points" can be set by you in [loss adjustment] setting.

Cooling period

If the buy force and the sell force compete at your strike price and your [stop loss] is set to very small, the hedge trade may be opened and closed continuously for several times. This will cost you much money. To avoid this, when the market price hits your strike price, you can delay the hedge action for [cooling] seconds. If the market price drops back to below your strike price after [cooling] seconds, system has no need to open the hedge trade.

Short a put options

Our robot understands both call options and put options. The operations are exactly the same. You can safely short both call options and put options together and add hedge actions for them.

Market rises in a month

When the market has a solid trend, number of hedge trades is small or even no need to hedge. The hedge cost is minimal and so your profit can be maximized.

Market drops in a month

When the market has a solid trend, number of hedge trades is small or even no need to hedge. The hedge cost is minimal and so your profit can be maximized.

Market rises then drops for few times

When a rise and drop cycle hits your strike price, you need to hedge the options. If such cycles appeared several times, you need to hedge the options several times. Since hedge trade has cost, your profit is reduced.

Market drops then rises for few times

When a rise and drop cycle hits your strike price, you need to hedge the options. If such cycles appeared several times, you need to hedge the options several times. Since hedge trade has cost, your profit is reduced.

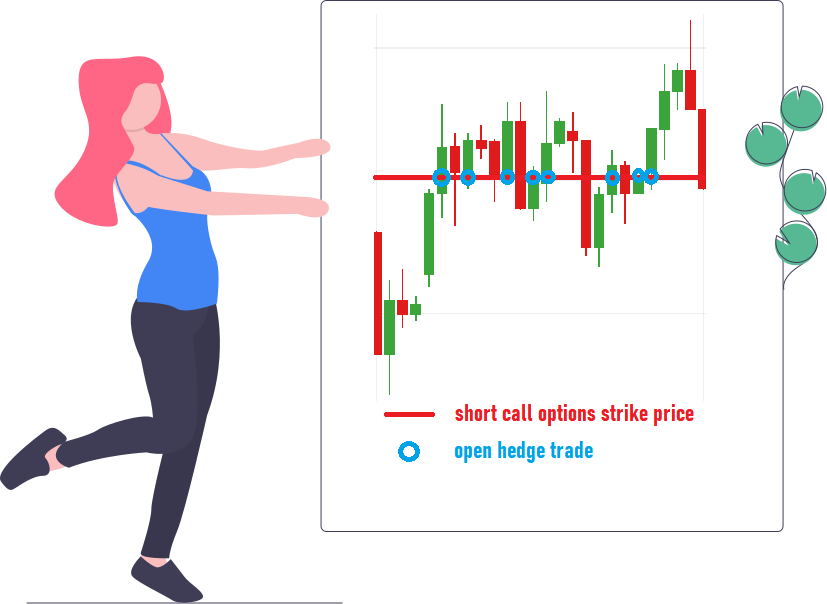

Market moves around your strike price

If the market price moves around your strike price, it implies that there are many hedge trades. Hedge trade has cost. When the hedge cost is more than the options premium, you lose money in that month.

Our Hedge System

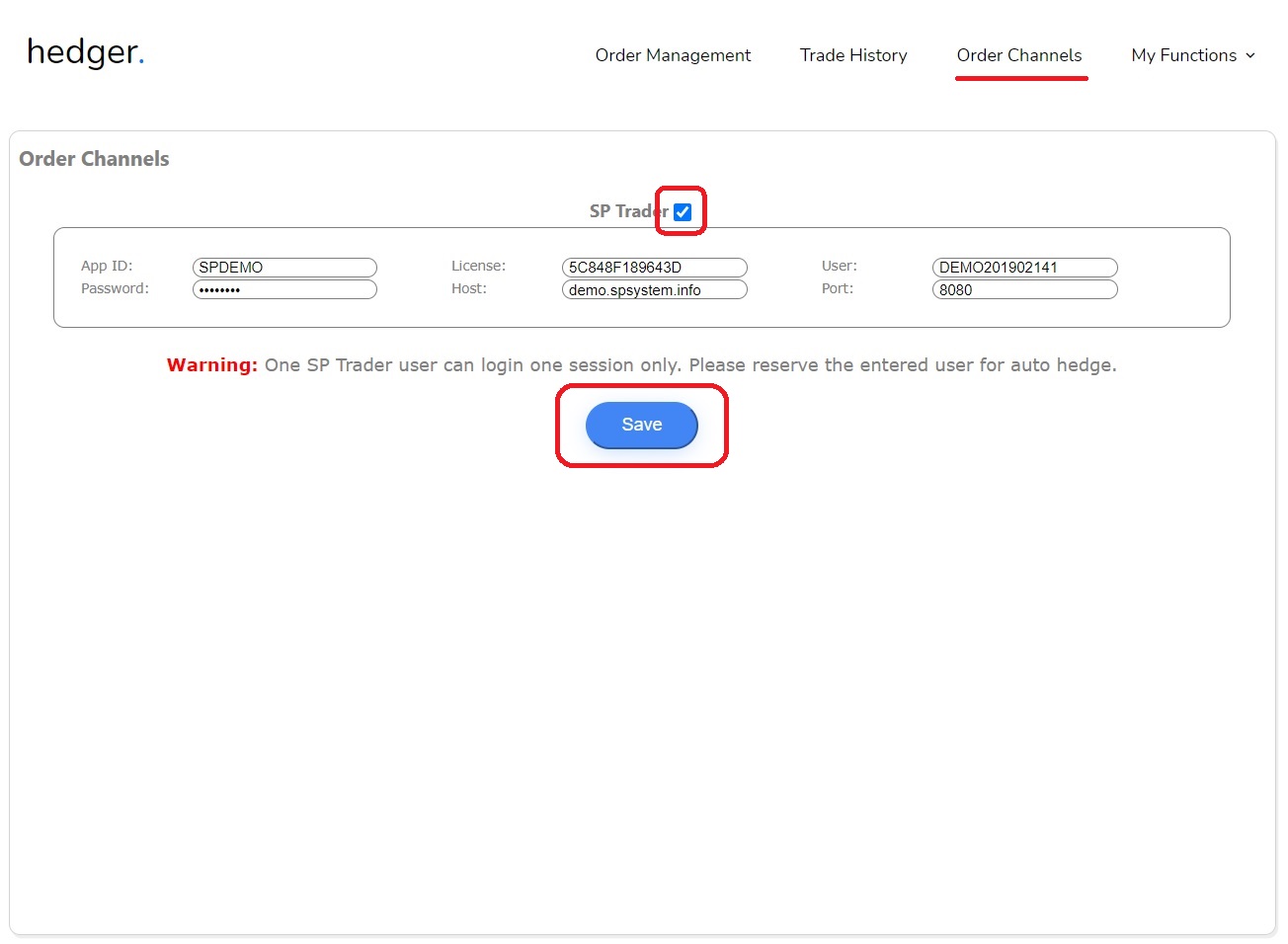

Setup SP Trader

After first successful login, you may setup your sp trader account information by choosing the menu item "Order Channels".

You need to enter all fields and please also ensure you ticked the checkbox beside "SP Trader". Then click the save button.

Please note that you cannot use the entered sp trader user in other application such as sp trader windows application when hedger is running. Hedger runs daily from 9am to 3am.

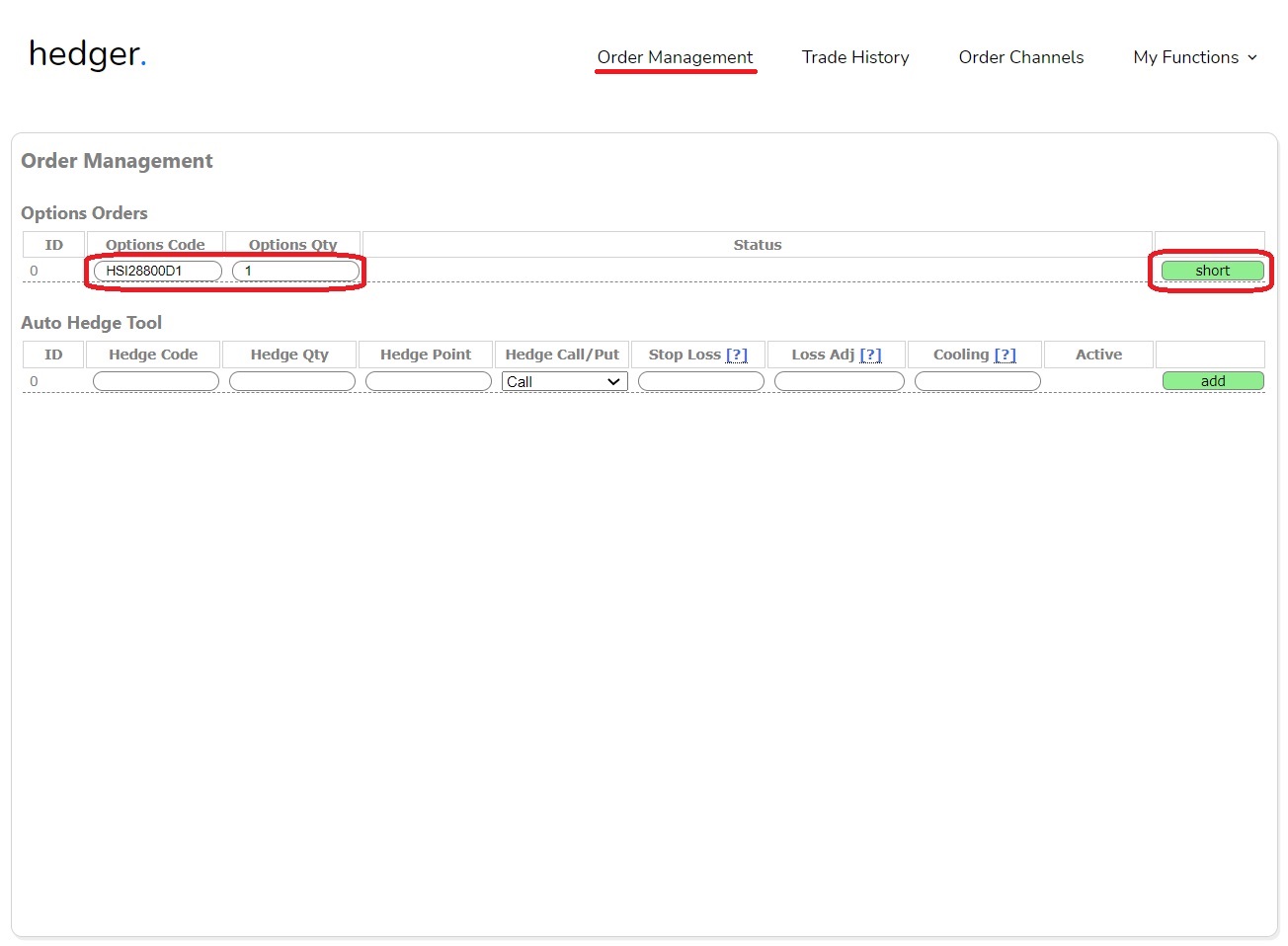

Place options order

Please choose the menu item "Order Management". You can place short options order in this screen.

Entering short options order is simple. Just key in the options code and deal quantity. Then click the short button.

If the short options order is executed successfully, you will see a close button to buy back the options anytime.

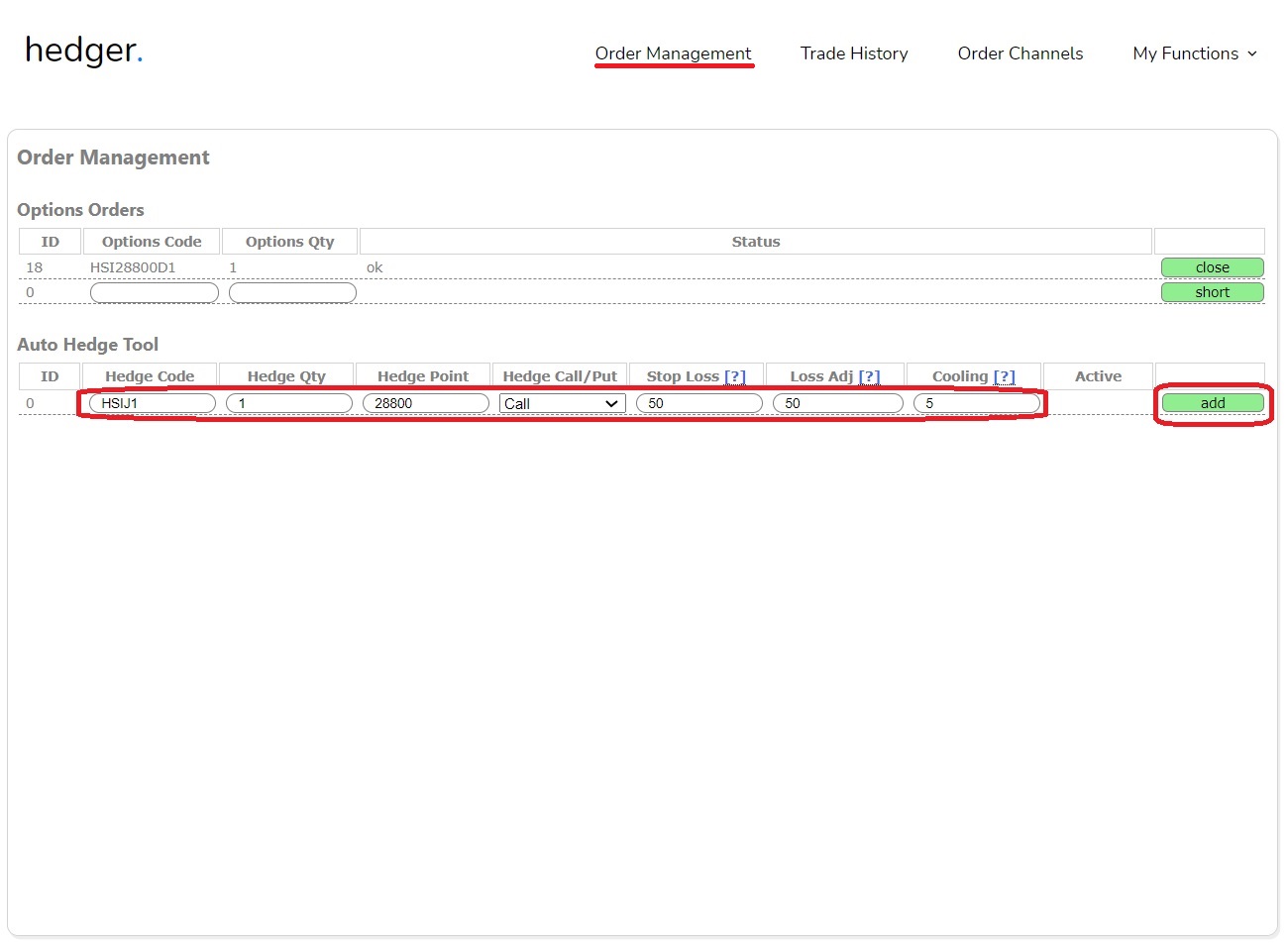

Add auto hedge instruction

Please choose the menu item "Order Management". You can add auto hedge instruction in this screen.

You can key in the futures corresponding to the options to start monitoring the market price.

You need to key in all fields in the row. Then click the add button.

If the auto hedge instruction is added successfully, you will see a disable button to disable the auto hedge instruction.

If there is an active hedge trade when you disable the auto hedge instruction, there will be a close button to close the existing hedge trade.

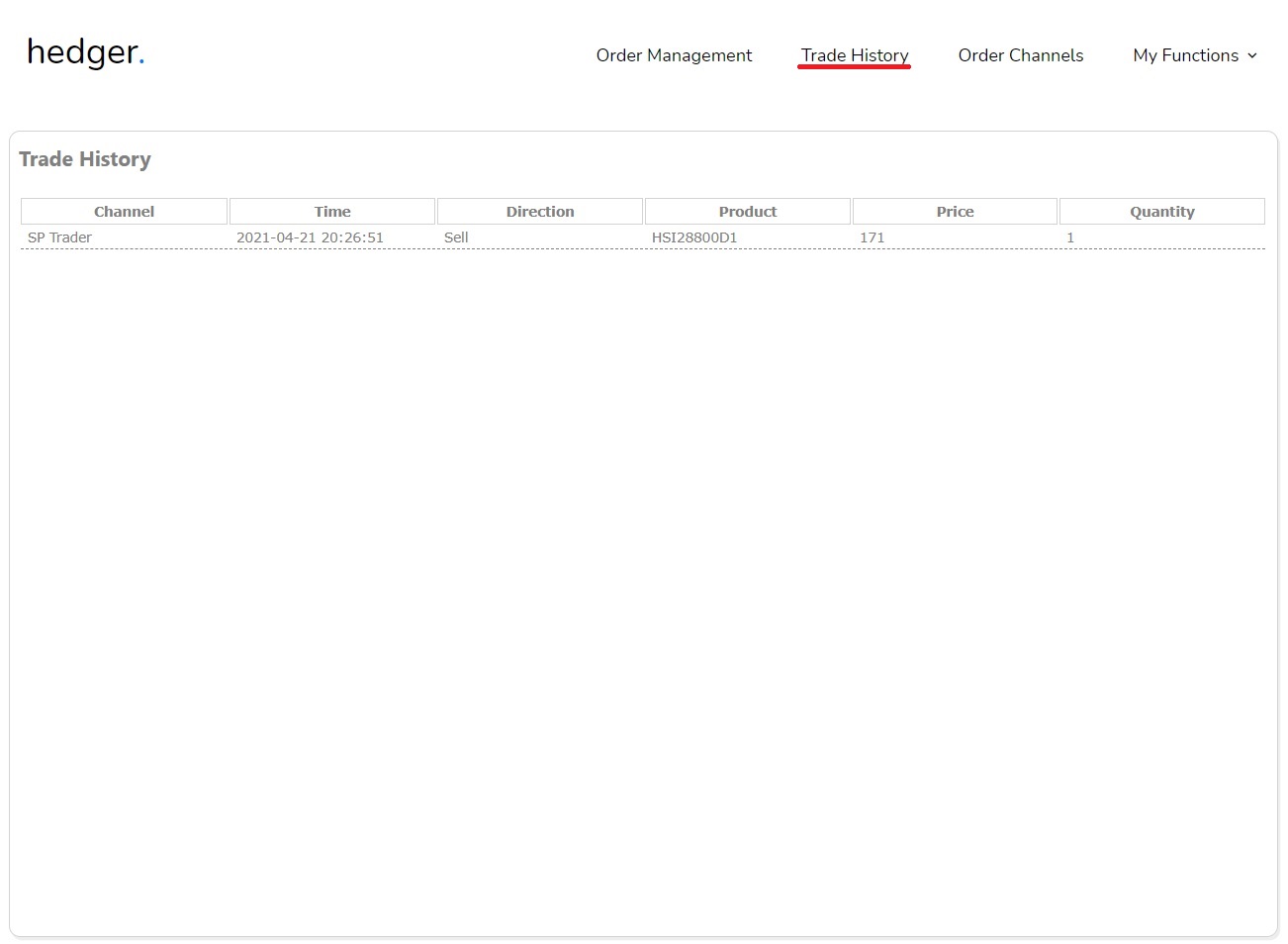

Check trade history

Please choose the menu item "Trade History". You can view the trade histories in this screen.

The trade histories are shown in descending order of trade execution time.

System shows the latest 45 days trade histories only.

Subscription

Service Plan

Our service plan is simple.

- Fixed monthly fee costs 1 credit.

- Plus adding one hedge row for 5 credits.

That's it.